The Section 179 Advantage: How Upgrading Your Work Van is a Smart Tax Write-Off

The Section 179 Advantage: How Upgrading Your Work Van is a Smart Tax Write-Off

As a business owner in West Michigan, you're constantly looking for ways to make smart financial decisions that help your company grow. One of the most powerful but often underutilized tools available to business owners is the Section 179 deduction from the IRS tax code.

This incentive is designed to encourage businesses to invest in themselves. When understood and used correctly, it can make a significant financial impact, especially when it comes to upgrading your commercial fleet. Before you finalize your year-end financials, it's worth understanding how this tax advantage can turn a necessary equipment purchase into a savvy tax write-off.

What is the Section 179 Deduction? A Simple Guide

In simple terms, Section 179 allows a business to deduct the full purchase price of qualifying new or used equipment from their gross income in the year it was purchased and put into service.

Instead of depreciating the asset over several years, you get to write off the entire expense right away. This directly lowers your taxable income for the year, which can result in a substantial tax saving. For a detailed breakdown of the official rules and limits, the best resource is the official IRS explanation of Section 179.

How Do Fleet Upgrades Qualify?

This is where it gets powerful for businesses that rely on vehicles. While there are specific rules for the vehicle purchase itself, much of the equipment you add to your work vehicles can qualify. To be eligible, the equipment must be purchased and put into service between January 1 and December 31 of the tax year.

Common qualifying upgrades include:

Permanent Shelving & Storage Systems: Custom shelving, bins, and toolbox systems that are bolted into your work van or truck are considered essential equipment. Explore our Commercial Upfitting solutions to see qualifying options.

Ladder & Material Racks: Heavy-duty ladder and material racks that are permanently affixed to the vehicle to perform daily work functions.

Safety & Job Site Equipment: This can include professionally hardwired equipment like commercial safety lighting , power inverters, and permanently installed air compressors.

GPS & Fleet Tracking Hardware: The physical hardware for a GPS tracking system is a common qualifying business asset that improves efficiency and security.

Vehicle Wraps: In many cases, a full or partial vehicle wrap used for advertising and branding can be classified as a marketing expense that is fully deductible. A wrap is a perfect way to boost your brand visibility.

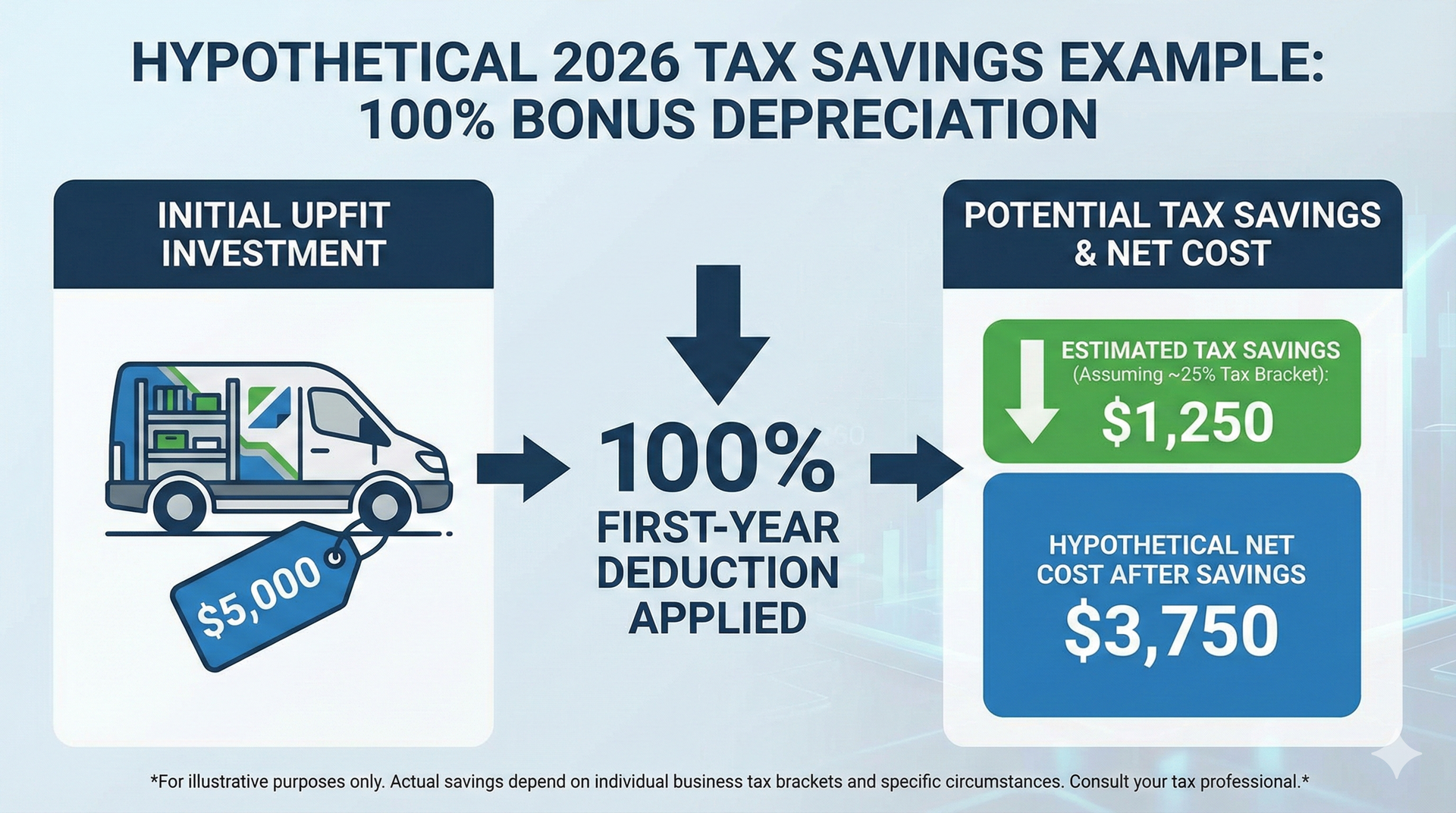

The Advantage for Your Business: An Example

Imagine your company is profitable this year and you decide to invest $10,000 in December to properly upfit a new work van with shelving, a ladder rack, and a branded wrap.

Instead of depreciating that $10,000 over several years, Section 179 could allow you to deduct the entire $10,000 from your business income this year. If you are in a 25% tax bracket, for example, that could translate to a direct tax saving of $2,500.

You get the benefit of a more efficient and professional vehicle and you lower your tax bill. For a deeper dive into how this works for different business types, resources like the U.S. Small Business Administration (SBA) offer excellent financial guidance.

Important Considerations for West Michigan Businesses

The Deadline is Key: The equipment must be purchased and placed into service by midnight on December 31, 2025, to count for the 2025 tax year. This is why planning in Q4 is so critical.

Professional Installation Matters: Having your equipment professionally installed provides clear documentation that the asset was placed into service for business use.

Consult Your Tax Professional: This is the most important step. The rules for Section 179 can be complex, and a qualified accountant is the only person who can provide official advice and confirm how these deductions apply to your specific financial situation.

Make a Smart Investment Before the Clock Runs Out

Upgrading your fleet is a proven way to increase efficiency and project a more professional image. Knowing that you can also leverage it for a significant tax advantage makes it one of the smartest year-end moves a business can make.

Don't wait until the last minute. Contact the commercial fleet experts at Auto Trim Group today to get a quote on the qualifying equipment you need. We'll help you get your vehicles outfitted and ready for a more profitable new year.

Important Disclaimer: Please Read Carefully

The content provided in this article, "The Section 179 Advantage: How Upgrading Your Work Van is a Smart Tax Write-Off," is intended for informational and educational purposes only. It is not intended to constitute, and should not be interpreted as, professional legal, financial, or tax advice.

Reliance on any information provided in this article is solely at your own risk. Tax laws and regulations are complex, subject to change, and their application can vary widely based on the specific facts and circumstances involved.

We strongly recommend that you consult with a qualified and licensed professional, such as a Certified Public Accountant (CPA) or tax attorney, to understand how the Section 179 deduction and other tax codes apply to your specific business and financial situation before making any investment or financial decisions.

Auto Trim Group, Inc. is a vehicle customization and upfitting company and does not provide financial or tax services. We assume no responsibility or liability for any errors or omissions in the content of this article or for any actions taken in reliance on the information provided.